Be Careful in Your Investments! We Are Nearer the Top Than the Bottom

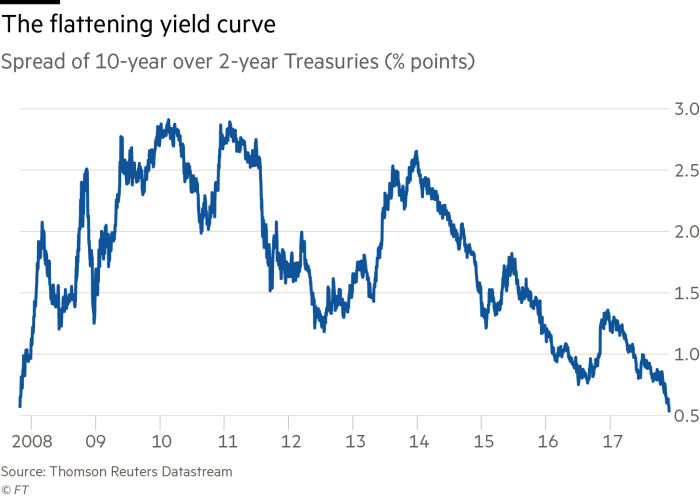

Let me first note I'm not a financial or monetary expert; what I'm going to try to do is to simplify discussion as a fellow investor.Here's the basic idea: a zero/negative difference between longer/shorter debt tends to be a harbinger of a recession. But longer-term debt is riskier than short-term financing. Rising interest rates raise the cost of financing and pressure profits, tied to stock prices. Sure, higher interest attracts investors relative to risky, possibly lower near-term returns from stocks.

How do we get a narrowing of interest rates? For one think, the Fed may be contributing to the problem by unwinding its balance sheet which basically takes money out of the economy. For example, it redeems maturing federal debt without rolling over the debt into new Treasury purchases. Also when it unwinds other debt, greater supply vs. demand for debt should translate to lower prices, which means higher interest rates.

On the other hand, l0-year Treasury bonds are seen as a better alternative (safer, higher interest) say than negative-rate European corporate bonds (i.e., you pay the corporation to take your money. Competition for a set number of T-bills should translate to insufficient supplies, higher costs, lower interest.

|

| Courtesy of FT |

Now we should be careful of how to translate this in terms of alternative investments--for example, lower tax payments and/or repatriating offshore assets could offset the need for financing. And it's possible that the Fed could worry raising rates or selling debt would trigger a recession and/or deflation.

There's a lot of speculation about the global melt-up, gold bugs thinking that the Fed will blink in efforts to defend the dollar, especially in its intent to avoid deflation. I personally want to avoid overly broad securities (say, the S&P), I think it's more of a sector pickers market, I don't believe the Fed can succeed in staving off a recession (including timing it), and I want some diversification from the domestic market; moreover, I probably want to keep some of my powder dry, i.e., cash. Can I time this game of investigator musical chairs? No. but I'm more disciplined about diversifying, cutting losers, reevaluating issues, and refusing to chase overbought stocks (or ETF's/mutual funds).

As always, invest at your own risk. I can't afford to screw up my retirement funds.

I Can't Stand Economic Illiterates

Whether we are talking about Trump's morally reprehensible increasing trade wars against 3 of our biggest customers (China, Canada, and Mexico), or some progressive believing the State monopoly will make "injustice wither away", I don't suffer fools gladly.Just remember a few things:

- the market for the upper 1% is very limited, and there are economies of scale--which benefit most consumers

- federal legislators and bureaucrats are the political 1%, special interest via public trust theory