|

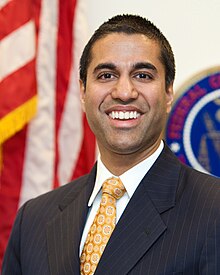

| Ajit Pai, Chair, FCC |

No, I didn't pick Trump again; it wasn't because he wouldn't agree to a deal to praise my blog or Twitter account. Last year Trump was an obvious choice because of his unlikely nomination and even less likely victory over Clinton, who had dominated their pairwise polls over the preceding year. It certainly wasn't an attempt to replicate Time Magazine's own choice (in fact, I don't remember reading their announcement at the time). Be clear: I was, then and now, a Never Trumper, but I was a Never Hillary person, too. There was a moment or two after I changed party affiliation to the LP after Trump clinched the GOP nomination I had flirted with the idea of casting a protest vote for Clinton, but given Clinton's lead in the polls, I never really seriously considered it. Granted, I had been curious why the Bush-Clinton fatigue that killed Jeb Bush's candidacy hadn't also hit Clinton's campaign, and even in Trump's election, I saw merit in the end of the Bush-Clinton era of politics.

So who did I consider this year? Well, obviously, you could argue that Trump's first year in office has been consequential; I've never seen the nearly daily soap opera--high-profile resignations, clashes with the press, threats of renewed conflict with North Korea, the unilateral recognition of Jerusalem as Israel's capital, failed ObamaCare reform, the tax reform kerfuffle, the seemingly endless Twitter provocations, the anti-Muslim travel ban, inappropriate comments on judicial proceedings, etc. I despise his economic illiterate positions against trade and immigration. Nevertheless, Trump has had certain silver linings, like his constructive regulatory reform and judicial appointments, particularly Justice Gorsuch. But there were other developments which were more significant and worthy in my judgment, including but not restricted to:

- The Rise of the FANG Stocks, i.e., Facebook, Amazon, Netflix, Google. All of these are centered in the sweet spot of the surging Internet economy. Much of the stock market rise this past year is due to their success. It's also been a day of reckoning for many brick-and-border chains struggling to compete in a transformed marketplace; some, like WalMart, are shrewdly mounting a late but impressive initiative (including free pickup at local stores). I thought that Time Magazine, with its shortlisting of Bezos, Amazon's CEO, came closest to the trend. In fact, my employer's recent Christmas party, featured Amazon device door prizes. (I already owned a Fire stick, Fire tablet, and Echo Dot. Amazon's signature eclectic Prime membership not only covers free 2-day shipping but free video, music, and reading content)

- The End of the ISIS Caliphate. We need to be wary of repeating George W. Bush's notorious "Mission Accomplished" moment; there are still a number of very dangerous militants out there, and I'm worried about Trump's continued intervention of Obama's drone wars and the recent unilateral Jerusalem recognition as Israel's capital.

- The Overthrow of Zimbabwe's Mugabe. The economically ruinous policies of the socialist Mugabe is a step forward towards freedom and a more open economy. Can we dare hope the liberation of Venezuela is next?

- Bitcoin and Blockchain Technologies. There are a number of trends I'm bullish on (although not necessarily at current prices), including cybersecurity, biotechnology, robotics, and cloud computing. Anyone not aware of the market-leading digital currency isn't paying attention; at the beginning of the year a Bitcoin had a market value of under $1000. The latest quote from Google shows a current value over $15,000. Just a month ago it was about half that. We are seeing volatility unlike anything I've seen like up to 20% daily spikes or corrections. Comparisons to Tulip Mania are already being made. Obviously a decentralized currency has an obvious appeal to us libertarians, wary of inflationary fiat currency policy, legal tender laws and central bank monopolies. But I think the real story is Blockchain which has all the markings of a disruptive technology, particularly in financial services.

Who earns my choice? Ajit Pai, the pro-market FCC chair, who has signaled that he is prepared to rollback Obama's regulatory foothold of government interference under the misleading oxymoron construct of so-called "net neutrality". This is one of the bright spots in a Trump Administration which in other areas seems to be expanding the imperial Presidency, and it seems one of the things that authoritarian Statists do is try to regulate content and/or other policies over the Internet.