As I start to write (Tuesday), my private retirement account is at an all-time high. But not by much: the aggregate has been cycling within a 2-point range for weeks now. I've done some recent closed-end fund purchases and have been whipsawed by things like dividend announcements that have sometimes resulted in up to 6% price drop or more in a single day. Presumably I'll eventually get those dividends back over the coming weeks. I try to minimize risks by diversifying, but if you do a simple Google search, you'll find a

tiny percentage of stocks (like FAANG) capture most of the general index gains. Diversification can control risks but also water down returns. I still have a lot of my retirement in cash, which yields next to nothing, but I don't find a lot of bargains, at least domestically in this market, and there are currency and other risks in the international markets. (I've been burned in global investments.) The bottom line is investing can be hard work. I have a bigger retirement account than many people my age, but you never know, like my late friend Bruce Breeding blew through over $1.2M (mostly covered by insurance) in 6 months of recovery following his major stroke. I don't have those types of resources, and at this stage of my career, I really can't risk a 30% or more brutal bear market haircut.

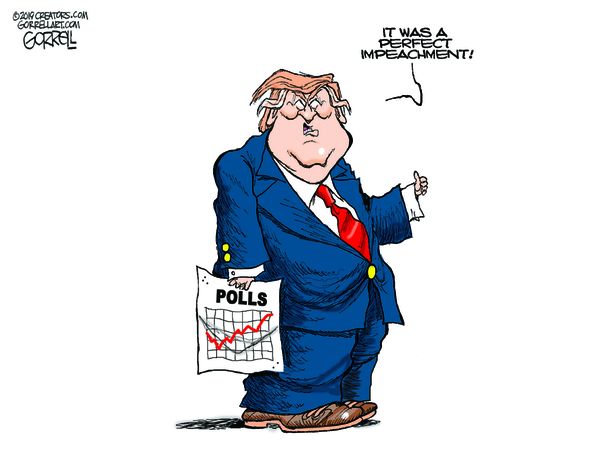

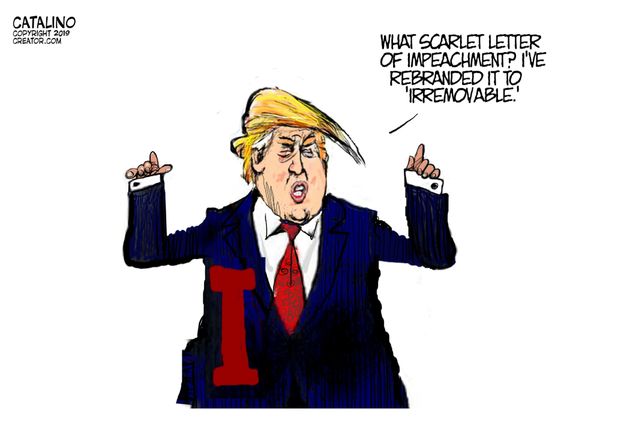

So if and when Trump roils the market with his economic-illiterate trade war threats, my retirement account goes down sometimes up to thousands of dollars. We've been lucky that the market has had the resiliency to bounce back eventually, but nobody ever knows if and when we've hit the market peak. One of these times it may go down and continue going down. Trump is gambling at the expense of my own retirement.

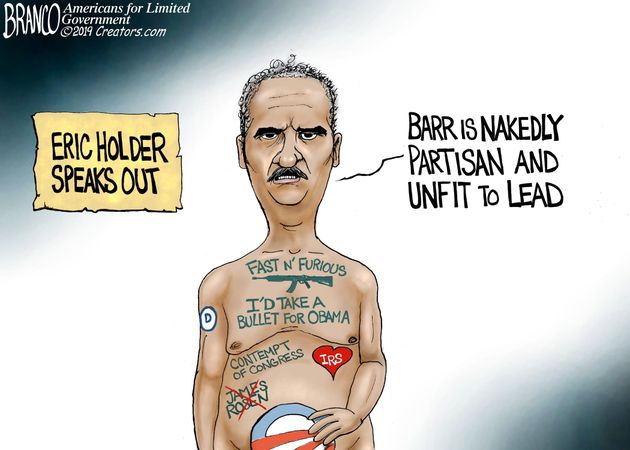

If you're a trained researcher (like me), listening to a political whore like Trump take credit for a robust economy and jobs is annoying, wrong, and misleading; it's even worse in Twitter world where the usual economic-illiterate progressives seem more annoyed that Trump is taking credit for "Obama's" recovery.

Let's be clear: this is not a miracle recovery of any kind. I personally know 3 IT professionals with over 20 years of experience looking for a job. It's still an employer's market; I know of 2 cases where the client refused to waive an incidental "requirement", e.g., a preference for a higher security clearance (which could be sponsored); the recruiter had found it impossible to find an available candidate, and the client had expressed a willingness to consider a lower-level entry who could be sponsored--and then reversed himself. I know back in 2014 I had a contingent offer on a Department of Energy contract which required a Q clearance, but there was a months-long backlog on clearances. I had been told it took a prior candidate 2 weeks to get his Q clearance. You don't earn money on a contingent contract, and I had to take another job in South Carolina. In a great number of cases you find the government specifying secret clearances where the job entails working on unclassified servers.

Some argue that much of the increase in employment reflects people taking "overqualified" lower-quality/paying jobs out of economic necessity. Let me quote

something from LinkedIn, a work networking portal:

"Today, you chat with them on Uber (I've updated it to suit the times), but the point is, you may see PhD's from India driving Ubers, MBAs from China working as waiters, and in general overqualified immigrants taking menial jobs."

Now let's point out both Obama and Trump had a robust quarter or two of economic growth of 3% or more but we have grown annually

below a long-term 3.21% since the turn of the century. And there

are issues with government unemployment statistics which understate the true unemployment numbers. Make no mistake; if your ruler is systematically biased, you are measuring improvements, but the question is what you are measuring. A lot of people "retired" jobless during the Great Recession. But don't try comparing this decades economy with the 1980s/1990s. I made my career-high earnings in 1999. My most recent contract paid $10/hour less than I was making 20 years ago. There were kids dropping out of college to take $50K or more jobs. That's not happening today. A lot of graduates

struggle to find a decent first job which requires their degree.

Let's start with the absurd idea that Obama was responsible for kickstarting us out of recession. How exactly? He took office at the end of January 2009. The recession ended just 5 months later. Now anyone who has taken a macroeconomics course knows about lags, e.g., in recognizing we're in a recession and in

response to relevant monetary (Federal Reserve action on interest rates) or fiscal (tax or stimulus) policy, which can take several months, up to 18 months or more; that's how we run into one interest rate hike too many. Recall that Bush signed a stimulus package (passed by a Dem-controlled Congress) into law in mid-February 2008. So, yes, Obama did sign another stimulus package a year later, but only a tiny fraction of the $750M or so (in a nearly $15T economy!) were spent before we emerged from recession. And keep in mind for much of the nineteenth century we had recovered from multiple recessions/depressions WITHOUT a central bank or large-scale federal spending. And recall that Bush had radically supersized federal spending before the economic tsunami without a resumption 90's type growth. Even if we assume policy made a difference in the economy (remember federal revenues are a reallocation of private economy resources in the first place), how do we tease out contributions to latent effects of the Bush stimulus and TARP, near-zero rates from the Fed, or Obama's stimulus? And even if the Obama stimulus helped, what about the role of the Congress in designing and passing the legislation?

And don't forget Obama was playing winners and losers in the economy (pushing, for instance, green jobs/businesses, education, and infrastructure spending) and massive new regulations and healthcare mandates on businesses and consumers as the economy. Obama caused some of the most massive economic uncertainty since FDR's policies exacerbated the Depression and despite an unprecedented near-zero interest rate his entire tenure in office, Obama never achieved more than a few isolated quarters, not years, of 3% growth. I'm not saying Obama is the only factor responsible for sluggish growth, but I'm arguing against those saying Obama was the reason for recovery.

So what can a President do for the economy? Not much,

like Kevin Williamson points out. Let me put my own spin on this. It's not like Obama had GDP growth and job faucets in the White House that broke and went unfixed during the last year of Bush 43's Presidency or Trump came into office with the flow barely flowing and turned the faucets higher. At best, a President has rudimentary tools at his disposal: he has influence over policy, like taxes, regulations, immigration and trade. He has some limited discretion delegated by Congress (unconstitutionally in my view) to fine-tune tariffs.

Like the Fed's similarly crude tools of setting interest rates, buying and selling financial assets, and regulations, the President's tools are limited and indirect in nature. There are a number of factors and risks involved in starting or expanding businesses and respective jobs. There are a number of things public policymakers can do to foster economic growth, including the following:

- simplify/reduce the government footprint (spending, taxes, mandates and other regulations)

- open immigration and trade to mitigate issues like labor restrictions and resource shortages, open new markets for trade to the 96% of the global population not in the US

- limit economic uncertainty caused by government policy changes

- pursue sound money policies

So what has Trump done with respect to this agenda?

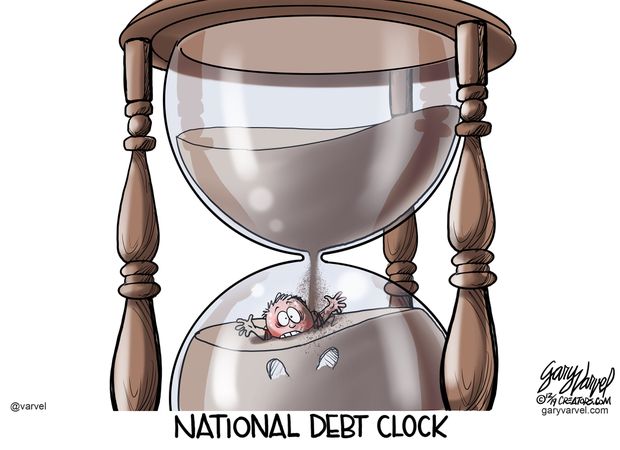

Very little. The national debt

was about 19.9T and is

currently about 23.1T, Despite a robust economy, we are actually expanding the unsustainable national debt; despite disingenuously paying lip service to paying down the debt, Trump basically dealt away hard-won GOP sequesters in his budget deals, principally a quid pro quo of domestic spending for his bloated defense budget, including the newly hyped Space Force. Trump is still pursuing an activist agenda in the Middle East/Gulf Region area, despite his soundbite of a suggestive America First policy and hints of withdrawing from Syria; the fact is he has appointed neo-con hawks to leadership. He has done almost zero with touching politically radioactive entitlements, accounting with over two-thirds of the federal budget, especially senior entitlements which will exhaust their reserves within 15 years.

Trump has had modest success on the tax and regulatory front, especially in reducing a globally high, noncompetitive business income tax and moving from a worldwide tax to a more hybrid territorial system; he has helped trimmed up to $25B or so in burdensome regulations through last, but the fact is that the

regulation burden went up 10 times higher during the 111th Congress alone under Obama. Also, as Williamson points out above, business tax and regulatory reform is more of a long-term issue, with limited short-term benefits which Trump is trying to claim. And keep in mind though that whereas $25B is a step in the right direction, it is almost negligible in the context of a $20.5T economy. Not to mention that Trump didn't have the political support to pass permanent policy changes, and a subsequent Dem administration could easily revert things like executive orders.

As for his job creation hype, keep in mind jobs enable core services and products and facilitate business objectives to the point the marginal benefits of labor meet its marginal costs, but labor is a cost; technology makes labor more productive over time, and keep in mind China and other countries are subject to the same trends seen in the US, i.e., half or more jobs are in the service sector and less than 20% of jobs are in the manufacturing sector. Many more jobs are lost to robotics and other technology than those presumably lost to global competitors. The good news is the higher standard of living gives people more resources to spend on other goods and services, a longer-term opportunity for job seekers. The failed business models Trump wants to resurrect are simply not sustainable.

Also in hyping "the best economy ever" with a low official unemployment issue, this is somewhat misleading in the sense that Trump has

rarely recovered part of the lower labor force participation rate which dropped from 65 to 62%; it's currently at about 63.3%, an improvement, and of course part of the story is an aging work force (baby boomers retiring). But best economy ever? Trump hasn't even met the long-term trend of 3.x% growth, never mind exceeded it, except for a few isolated quarters--and Obama did the same. I think you can make an argument that Trump has been better for the economy than Obama, but the growth rate is mediocre compared to what we saw in the 80's and 90's.

Don't get me started on "Tariff Man" and Trump's unprovoked trade wars. A mere hint of new or more aggressive trade policy will tank the stock market. Trump doesn't conceptually understand the trade deficit (we have had more robust economic growth while running a deficit) which is financed by a capital surplus. Tariffs are paid by Americans, not foreign producers, and ultimately Trump's tariffs benefit a concentrated few versus the many. For example, tariffs or quotas on foreign steel and sugar resource-using companies (like car and candy manufacturers respectively); higher costs make American goods and services less competitive globally. These costs reduce our standard of living.

The same goes for Trump's economically illiterate immigration policy. Open immigration benefited the rise of the American economy to global leadership in the nineteenth century--without a federal welfare system. Studies beyond the scope of this post point out the win-win proposition of liberalized immigration.

Finally, Trump has been pressing the Federal Reverse to lower rates (almost every President running for President has done this, of course, wanting a robust economy on election day), even pressing for negative rates as in the weaker developed economies. It ignores the fact that beggar thy neighbor currency wars are a race to the bottom and a recipe for a global recession or worse. One of the reasons we are attracting foreign capital is because of a good economy and a strong currency; Trump is playing with fire, just as he failed to understand that China would respond to his tariffs with their own, aimed at his rural base selling exports and Trump responds with bailouts of affected farmers.

What I can tell you is that the American economy would be stronger today than under the meddling of Obama and now Trump; the true recipe for economic growth is the free market, free trade, and open immigration.