The man who makes no mistakes does not usually make anything.

Bishop W.C. Magee

Reader Note

For job-related reasons, my daily publication schedule may be affected over the coming month. I don't expect a prolonged absence. I may preschedule some abbreviated posts.

Tweet of the Day

Immigrant Claudia Perez operates a food cart, illegal in Chicago. Chicago needs to embrace competitive street eats! https://t.co/wuCNFBHN6S

— Ronald Guillemette (@raguillem) February 28, 2015

Immigrant entrepreneurs like Claudia Perez help make America great; I wish there were millions more just like her. http://t.co/tsrEW9pCdY

— Ronald Guillemette (@raguillem) February 28, 2015

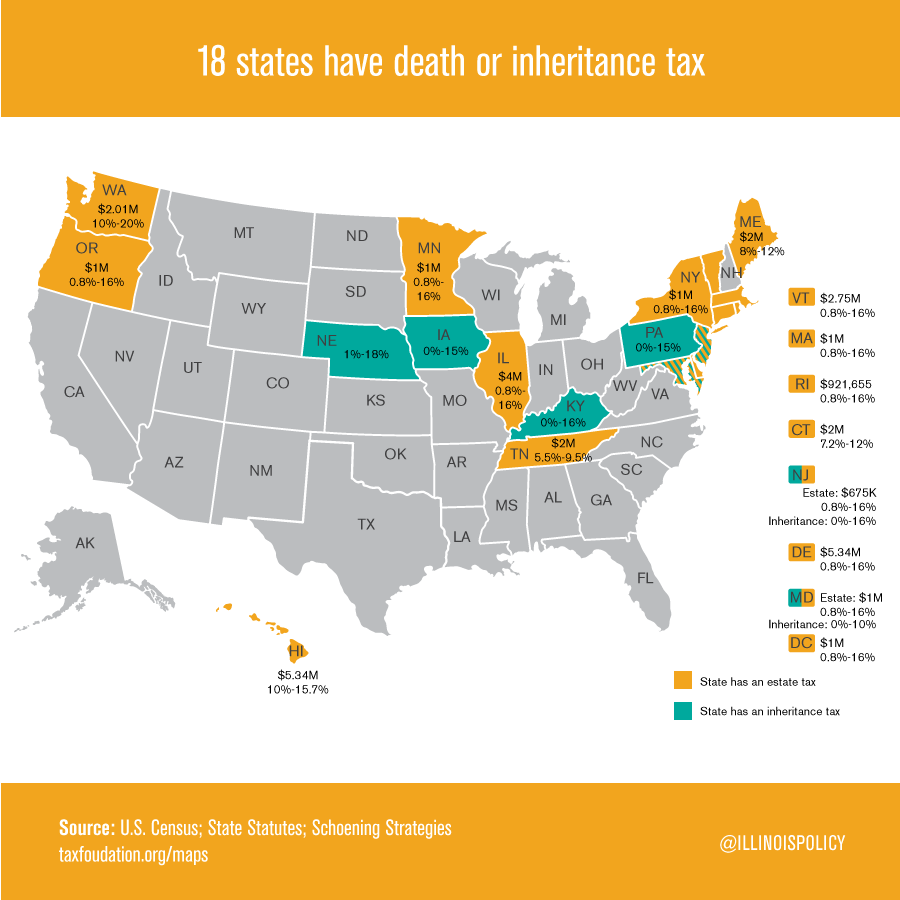

Chart of the Day: Kill the Death Tax! |

| Courtesy of IPI |

|

| Via Facebook commenter |

Keynesian Madness

In a little noticed revision, fourth quarter 2014 slowed from the two previous quarters (2.2% vs. 2.6%), reflecting a slowdown in investment (including inventory), a widening trade gap, and lower federal spending; last year's 2.4% GDP growth was unchanged. Many economists are encouraged, pointing at strengthening consumer spending and lower-than-expected inventory, expecting expanded production to meet consumer demand.

Now for those who don't remember Econ 101, we have two well-known abstractions: GDP = C + I + G + (X — M) and GDP = C + S + T (where the variables are consumption, investment, government spending, exports, imports, savings, taxes. One trite observation is that consumption accounts for about 70% of GDP. There are all sorts of inferences one can make by holding variables constant and manipulating these abstractions (e.g., net exports can increase by exporting more or importing less or increases in government spending can boost the economy). Of course, in the real world, there are tradeoffs; government taxes subtract from private consumption, savings and investment. Current consumption and/or taxes displaces savings (i.e., future consumption). Trade restrictions can affect the individual's standard of living; exporters can achieve economies of scale from an expanded customer base, and companies and consumers can benefit from the increased supply and variety of imported goods or materials. Now MMT (modern monetary theory) expands on these concepts and inferences from abstractions, which many Austrian School critics see as hopelessly divorced from economics below the surface; for example, we can't tell the difference between organic growth vs. capital consumption (not a good thing). [I can't resist adding a non-economics example for an analogy. In relational databases, we have base objects like tables versus virtual objects called views. At a former employer, there was a developer who devised a product he called ViewGen which basically built views on views. The problem was even though the ViewGen result was logically coherent, its output views were resource hogs with related conventional table operations much faster and efficient.] Bob Murphy has a memorable essay; he then globalizes the equations (net trade concepts cancel out) and then equates the government deficit to net savings; the result leads to counterintuitive results like government surpluses translates into negative savings (capital consumption). He then goes on to describe a simple "Robinson Crusoe" example where savings of coconuts gives Crusoe time to invest in coconut-harvest technology which expands his coconut productivity--all without the megalomaniac concept of a centrally planned government and Fed.

The reason for this prolonged discussion is I ran into this nonsense from a financial investment website, which extols related Keynesian "virtues". It starts with an adoring reflection of Humphrey-Hawkins. Among other things, this legislation outlined a number of economic objectives for both fiscal and monetary policy. The author notes that the measure called for government "make work" schemes if the private sector couldn't meet full employment objectives. He then skips over to the Great Recession, arguing that the wild stimulus spending was responsible for a brief economic boost--until it was aborted by the Tea Party Congress and austerity. The author suggests that the monetary policy from the Fed has primarily benefitted the upper 1%, while the federal government has failed on its end through redistribution policies (he only says this indirectly, pointing out that millionaires don't spend as much as that marginal unspent million being split up among high-spending middle income folks), boondoggle infrastructure projects, and argues, horror of horrors, there have been net job losses to public employment since the Great Recession.

First of all, 5 of 6 workers are in the private sector, which has not done well at all since 2000. The private sector, unlike the public sector, lost jobs over the Bush Presidency and only recently came close to recovering job losses over the recession--not to mention millions more prospective workers have joined the labor force, and we are still near decades-low labor force participation rates. Not to mention many of the new jobs are part-time and/or lower-earning than former jobs. In a robust economy, we would see wages rising more than what we are seeing. Second, government revenues have been recovering, but spending has gone out of control, notably by pension costs outstripping revenue gains. Government "make work" jobs are not only extraordinarily expensive, inefficient and ineffective, but the jobs are insufficient to make a dent in overall hiring. Third, the idea we've had any kind of recovery is more a tribute to the resiliency of the economy despite policy failures by the Congress and the Fed; we had rapid recoveries during the Gilded Age without a central bank or large-footprint federal government. There are lots of things the author leaves out--regime uncertainty, the fact that higher-worth individuals lost far more during the recession (see here, for instance)--because much of their wealth was tied up in assets that went down sharply (the current author argues that the middle-income people had to liquidate their assets before the Fed-induced asset recovery); I covered this in a recent post. I could go on, but the main point has been established: government is the problem, not part of the solution.

The Next POTUS

Facebook Corner

(Drudge Report). What is the biggest problem the United States should be dealing with?

Balancing the budget and paying down the national debt and fixing the unsustainable unfunded entitlement issues, in particular social security and expanding federal health programs, accounting for about 70% (and increasing) of the federal budget.

(Rand Paul 2016). John Bolton says the Iraq War was necessary to stop Saddam from starting a nuclear war.

Bolton is still trying to rationalize two unnecessary wars that took over 4000 American lives and still more casualties and over a trillion dollars we didn't have. Bush nearly doubled the national debt, and Obama will come close to doubling it again while carrying out consistent interventionist policy, as if we had a legitimate mandate to serve as the world's unwanted, unpaid policeman.

(Rand Paul 2016). Rand Paul: Your phone records are none of the government's 'damn business'

I was not as impressed once I re-read what he said....the phone records of law-abiding citizens are none of the governments business....how is the government to know who is or isn't law abiding if they don't have access? Hair splitting by Mr Paul. I'm disappointed

Absolutely wrong OP. There is no right to know by the government. That's what the Fourth Amendment is all about. There's a cost/benefit to data collection/analysis, and the State must prove its case.

(IPI). The death tax is Illinois’ strongest driver of out-migration.

Illinois does not have an estate tax. The estate tax is a federal tax only. It was created so as to prevent the creation of a monied gentry after the guilded age. If you read the writings of the founding fathers you will see their warnings that the accumulation of too much wealth in the hands of a few is a danger to the republic. Also, family farms are exempt from estate taxes as long as a family member farms the land for ten years. The problem with the estate tax is the low valuation of wealth. The tax should only kick in with excesses of 20 million or so. This would save small businesses from being sold off to pay the tax.

What an ignorant, contemptible, greedy, morally corrupt toad you are. First of all, you are dead wrong, jerk. Illinois DOES have an estate tax: Lisa Madigan's portal has links to the tax forms. Second, the Founding Fathers believed in unalienable property rights. Third, the few times before 1916 there were relevant taxes established, they were subsequently repealed

(continued on an IPI post on Claudia Perez, an immigrant who sell tamales from a food cart in Chicago. My comment has attracted 256 likes to date, which I think is a personal record)

she doesnt have a food safe certification.. she doesnt know the health codes. there are a ton of health and safety violation in this video. her cart would never pass an inspection cause she doesnt have a way to keep temperatures in check or hand washing sinks. food carts are against the law. people need to come to terms with that. its for a good reason. its for your safety. ive seen too many people get extremely sick from these things.. and some have even died. this is a serious issue.

This fear-mongering is anti-competitive and unconscionable. The very fact Claudia has been able to raise a family for years on selling good food to repeat customers speaks for itself. I'm sure self-serving health department bureaucrats exploit these needless fears--as if I believe in a government over someone whose livelihood depends on selling consistent quality food and service!

But the Institute for Justice, a companion free-market organization to IPI, has this to say about food carts/trucks:

"An idea persists that food from trucks and sidewalk carts is unclean and unsafe. Street Eats, Safe Eats tests that common, but unsubstantiated claim by reviewing more than 260,000 food-safety inspection reports from seven large American cities. In each of those cities, mobile vendors are covered by the same health codes and inspection regimes as restaurants and other brick-and-mortar businesses, allowing an apples-to-apples comparison.

"Street Eats, Safe Eats finds that in every city examined—Boston, Las Vegas, Los Angeles, Louisville, Miami, Seattle and Washington, D.C.—food trucks and carts did as well as or better than restaurants.

"The results suggest that the notion that street food is unsafe is a myth. They also suggest that the recipe for clean and safe food trucks is simple—inspections. More burdensome regulations proposed in the name of food safety, such as outright bans and limits on when and where mobile vendors may work, do not make street food safer—they just make it harder to get."

For a copy of Street Eats, Safe Eats, see here: https://www.ij.org/.../vending/street-eats-safe-eats.pdf

Choose Life: Adoption Is A Beautiful Thing

Political Cartoon

|

| Courtesy of Michael Ramirez via Facebook commenter |

| Courtesy of Lisa Benson via Townhall |

James Taylor, "Never Die Young"