The key to successful leadership today is influence, not authority.

Kenneth Blanchard

End Civil Forfeiture NOW: A Case Win/Update

I know several weeks back I posted a video (second below) from the Institute for Justice, about the Caswells, a Massachusetts retirement-age motel-owner couple, whom found their business seized because people violated drug laws on their property without their knowledge or consent. I'll post a case update after the second video below:

In a major victory against government predators:

A federal court in Massachusetts dismissed a civil forfeiture action against the Motel Caswell. Magistrate Judge Judith G. Dein of the U.S. District Court for the District of Massachusetts concluded, based on a week-long bench trial in November 2012, that the motel was not subject to forfeiture under federal law and that its owners were wholly innocent of any wrongdoing.The government had sought to take the Motel Caswell from the Caswell family under the theory that the motel allegedly facilitated drug crimes. But the court found that Mr. Caswell “did not know the guests involved in the drug crimes, did not know of their anticipated criminal behavior at the time they registered as guests, and did not know of the drug crimes while they were occurring.”Factoids of the Day:

The Obama Recovery

According to Hoisington Investment (my edits):

- The one complete decade of the 21st century (2000 through 2009) ranks as the 21st slowest growth in real GDP of the entire 22 decades since 1790

- The Highest Marginal Tax Rates in 27 Years:

- A 4.6% increase in the top marginal tax rate to 39.6%;

- A phase-out of itemized deductions (mortgage interest expense, various state taxes - income, property and sales - and charitable gifts) for high-earners;

- A phase-out and elimination of personal exemptions for high-earners;

- An increase in the tax rate to 20% for capital gains and dividends for high earners;

- A 3.8% surtax on capital gains, dividends and other investment-type incomes for high-earners;

- A 0.9% surtax added to the Medicare tax for high-earners;

- The current tax hike is on par with the one in 1937, which imposed the first FICA tax, boosted the marginal tax rate from 56% to 62% and imposed an excess corporate profits tax. The economy, which had made some recovery from 1934-36, fell back sharply in 1937 and 1938. While other factors, such as retaliatory currency devaluations and monetary policy mistakes, were also occurring, the 1937 tax increase served to prolong the Great Depression. The marginal tax rates are now above 50% in the high tax states such as California, Illinois, New York and New Jersey

- Consistent with the academic research, we could not find historical precedent for the proposition that prolonged deficit spending achieved prosperity. Numerous examples of great empires like the Mesopotamian, Roman and the Bourbons of France collapsed under the weight of high government debt.

- As high debt levels diminish economic performance, interest rates remain low for protracted periods of time. Ultimately, however, the marketplace may lose confidence in the government’s ability to sustain the debt levels, and a country will reach Reinhardt and Rogoff’s “bang point” or Cochrane’s “condition”, causing interest rates to rise.

- Median household income is at its lowest level since 1995

- The percentage of people aged 25-34 living with their parents is at an all-time high

- One out of every 6.5 Americans receives food stamps

- The employment-to-population ratio stands near its lowest levels in three decades.

in the People's Republic of California

I wasn't aware of superstar pro golfer Phil Mickelson''s apology over a tax comment kerfuffle:

Mickelson said after Sunday's PGA event in La Quinta he might have to take "drastic measures" that could include leaving the state because of the increased financial burden he has incurred due to recent changes in California's tax laws. [Apparently the golfer's comments caused a firestorm, and he subsequently apologized.] "My apology is for talking about it publicly...I think it was insensitive to talk about it publicly to those people who are not able to find a job, that are struggling paycheck to paycheck."You know, Phil, you are not responsible for California's Democrats' corrupt union deals resulting in cushy up to 6-figure annual retirement pensions as early as their 50's and mismanagement of the state. Unlike state income tax-free Texas and Florida, California did not gain any Congressional seats in the last census, and many businesses have moved or are moving headquarters to more business-friendly states like Texas.

It's hypocritical that politically liberal/progressive celebrities like investor Warren Buffett are free to express their opinions, so long as they support discriminatory legalized plunder. It reminds me of the famous anecdote about the greatest baseball player/slugger ever, Babe Ruth, being asked about whether it was right for Ruth to make more than the President. (Ruth responded that he had had a better year.) Well, of course, Phil Mickelson has had a far better last 4 years than Obama....(I realize that's not saying much...)

I realize that some people might be jealous of an athlete making a good living playing a game most people have to pay (greens fees) to play. But Mickelson, a class act, draws fans to tournaments and television, which translates to good money. He's not an economics-illiterate President, governor or legislator taxing, spending and interfering with the free markets with burdensome, meddlesome policies and sucking up resources from the real economy to fund grossly ineffective, inefficient, incompetent government.

Phil, go east, young man, to Texas. Grab a chicken-fried steak, homemade mashed potatoes, all slathered with creamy gravy, made-from-scratch, warm-from-the-oven rolls, and a thick slice of pecan pie, washing it all down with sweet tea or a long neck, while listening to some great Texas country music. (I just described a cross between a Texas diner and Goode Company BBQ--maybe not chicken-fried steak, but great brisket, sausage or chicken. I miss Houston!)

Nice friendly folks, not judgmental elitist snobs whom didn't have to nail a 30-foot putt with a tournament on the line to get the green in your pocket and whose idea of golf is limited to what Obama did during the BP oil spill crisis.

Isn't It Time We Stop Meddling

In the Internal Affairs of Other Countries?

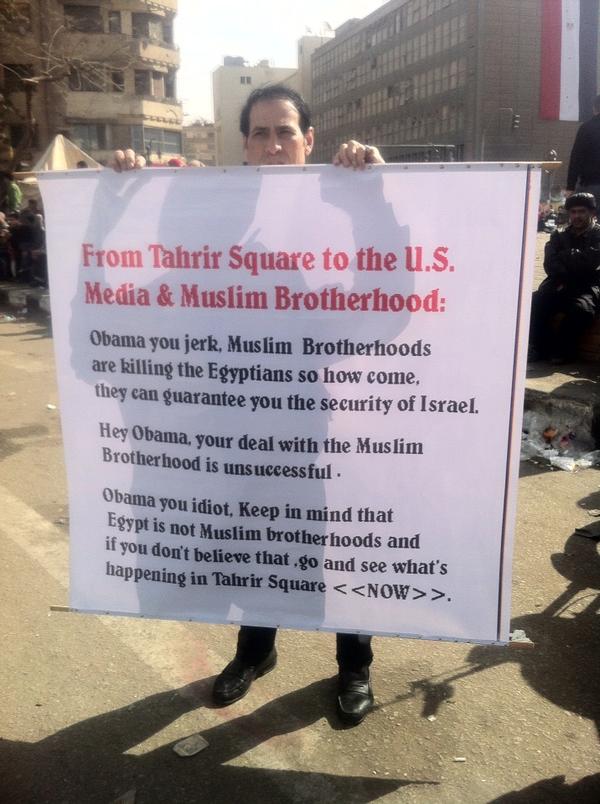

Is Obama a "jerk" or an "idiot"? People are entitled to their opinions, hut I don't think he's an idiot--he's merely incompetent, totally ignorant of the law of unintended consequences. His Egyptian policy is an incoherent, ill-advised, meddlesome, convoluted, seat-of-the-pants mess. Of course, Obama shares some responsibility for the status quo, including insufficient protections for basic liberties in a perversely factional form of democracy.

|

| Courtesy of Twitchy |

John Kerry Was Against Unauthorized Intervention

Before He Was For It....

Sen. Rand Paul continues to impress. John Kerry, of course, is not going to undermine Obama's Middle East policy. Kerry is making an unsustainable argument: does the US intervene in all cases involving human rights or just politically convenient and arbitrary ones? Where in the US Constitution is Obama allowed to bomb the territories of countries like Libya, Yemen and Pakistan which have not attacked us?

I understand the President felt that foreign civilians were in imminent danger, but this did not involve American interests and as such I consider his actions unconstitutional. In fact, John Kerry is misrepresenting the facts: the Libya action was not simply a tactical response that Kerry is describing: Congress declared war in a matter of hours after Pearl Harbor. Whether or not Kerry personally approved of US intervention in Grenada, Yugoslavia, or Panama is beside the point; they certainly were not defensive military actions, and he was one of 535: Obama could have and should have referred the matter to Congress.. I suspect that the Congress would have ultimately gone along with reluctant neo-con support; although I, the Pauls, a few Tea Partiers and possibly some antiwar Dems would have opposed the action. The fact that Obama refused to cooperate was a gift to neo-con critics: one of the Bush war rationalizations was the spread of democracy, and there's no way they want to appear soft on terrorism.

Musical Interlude: My Favorite Groups

The Cars, "Magic"